Some Of Personal Loans copyright

Table of ContentsGetting The Personal Loans copyright To WorkThe Ultimate Guide To Personal Loans copyrightThe Ultimate Guide To Personal Loans copyrightFascination About Personal Loans copyrightFascination About Personal Loans copyright

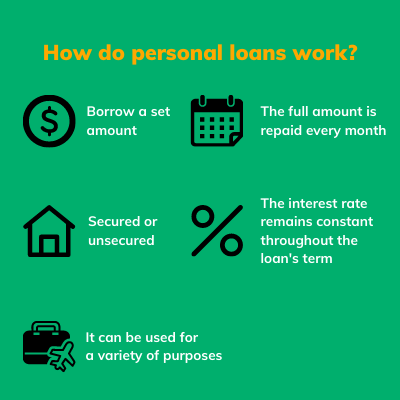

Payment terms at a lot of personal finance lenders vary between one and 7 years. You obtain all of the funds at the same time and can utilize them for almost any type of purpose. Customers commonly use them to fund a property, such as a lorry or a watercraft, settle financial obligation or assistance cover the expense of a significant cost, like a wedding event or a home renovation.

Personal finances come with a dealt with principal and passion monthly repayment for the life of the car loan, calculated by building up the principal and the rate of interest. A fixed rate provides you the safety and security of a predictable monthly repayment, making it a prominent selection for settling variable rate charge card. Settlement timelines differ for personal lendings, however consumers are often able to pick repayment terms in between one and seven years.

8 Easy Facts About Personal Loans copyright Shown

You might pay an initial origination charge of approximately 10 percent for an individual finance. The fee is typically deducted from your funds when you settle your application, decreasing the quantity of cash you pocket. Personal fundings prices are much more directly connected to short-term rates like the prime rate.

You might be used a reduced APR for a much shorter term, due to the fact that lenders understand your balance will be settled quicker. They may charge a higher rate for longer terms knowing the longer you have a funding, the more probable something can transform in your finances that can make the repayment expensive.

An individual additional resources loan is likewise a great alternative to using bank card, because you borrow money at a fixed price with a guaranteed benefit date based on the term you pick. Remember: When the honeymoon is over, the monthly settlements will certainly be a reminder of the cash you invested.

The Main Principles Of Personal Loans copyright

Contrast interest rates, charges and lending institution credibility prior to using for the loan. Your credit history rating is a large factor in establishing your eligibility for the funding as well as the rate of interest rate.

Prior to using, understand what your score is so that you understand what to expect in regards to costs. Be on the hunt for hidden fees and fines by reading the lending institution's conditions page so you do not end up with less money than you require for your economic objectives.

They're much easier to qualify for than home equity fundings or other secured lendings, you still need to show the loan provider you have the means to pay the financing back. Individual loans are much better than credit scores cards if you desire an established monthly payment and require all of your funds at when.

Personal Loans copyright - Truths

Credit score cards might additionally use rewards or cash-back alternatives that individual financings don't.

Some lenders might also bill fees for individual lendings. Personal financings are finances that can cover a number of personal expenses.

, there's usually a set end day by which the funding will certainly be paid off. A personal line of credit report, on the various other hand, may stay open and offered to you indefinitely as long as your account remains in great standing with your lender.

The cash received on the car loan is not tired. Nonetheless, if the lender forgives the car loan, it is thought about a canceled financial debt, which quantity can be strained. Personal fundings might be protected or unsafe. A protected individual loan needs some sort of security click here for more as a condition of loaning. You may protect an individual car loan with cash properties, such as a cost savings account or certificate of down payment (CD), or with a physical property, such as your auto or boat.

The Personal Loans copyright Statements

An unsafe individual car loan needs no security to obtain cash. Banks, credit scores unions, and online loan providers can use both safeguarded and unsecured individual loans to certified debtors.

Again, this can be a bank, lending institution, or online personal car loan lender. Typically, you would first complete an application. The loan provider reviews it and decides whether to approve or refute it. If accepted, you'll be offered the financing terms, which you can approve or deny. If you concur to them, the following step is settling your funding documents.